Terms

Introduction

The aim of this leaflet is to set out some important details about the basis on which we propose to provide the services of this practice to you and how you can help us to do the best job possible for you. This is an important document especially if you might become unhappy with our services in any way and we recommend that you keep it for future reference. Unless we agree otherwise, the terms that are set out in this leaflet form the basis of the contract between you and this practice under which we will be acting for you on this and any future work that we do for you.

General

The Solicitors Regulation Authority obliges solicitors to provide clients with certain information about the way that their professional business is undertaken. Please find detailed below our standard terms and conditions, which set out the basis upon which Parkview Solicitors Ltd will carry out the work on your behalf. Parkview Solicitors LTD trading as Parkview Solicitors and Higher Court Advocates and Parkview Solicitors is a firm of Solicitors registered as a company in England & Wales Registration Number 10615684. Our Head Office address is: Hamill House 112-116 Chorley New Road, Bolton BL1 4DH. We are authorised and regulated by the Solicitors Regulation Authority. Our authorisation number is 636959.

Appointments & Office Hours

Our normal office opening hours are 9.00am 5.00pm Mon-Fri. Please help us to maintain a high standard of service by making an appointment if you want to see your caseworker. If you call in to see someone urgently we will do our best to see you if possible, but without an appointment this might not always be possible.

Keeping Us Up To Date

We will need your regular instructions, so please remember to let us know promptly of any change of address or telephone number, or if you are going away. Although we will usually tell you what we need to know, we also rely on you to tell us about any relevant developments or anything else that we should know. If you do so as soon as possible it might help to prevent wasted time and costs.

Contact by Email

If you give us your e-mail address we will assume we can use it to send e-mail and other documents unless you ask us not to. Please remember that the internet is not completely secure and that some confidential and sensitive material is best sent by other means.

Your Case Handler

We try to avoid changing the person dealing with your work mid-stream. If we have to do that, we will try to make sure you know as soon as possible, and let you know the reason for the change (and whether it has any effect on your charges). We will only allocate someone to your work who is appropriately trained and experienced in that work. Where the person dealing with your work is a non-lawyer we will notify you of the status of the fee earner and experience in carrying out the work.

Proof of Identity

The law requires solicitors to obtain satisfactory evidence of the identity of their clients and sometimes people related to them. This is because solicitors who deal with money and property on behalf of their clients may be used by criminals wanting to launder money. To comply with the law, we need to get evidence of your identity as soon as possible. It is our practice to ask to see two pieces of identification.

One must include your name and date of birth, for example, see list below:

-

- Current signed passport

-

- Birth certificate

-

- Current photocard driver’s license

-

- Current EEA member state identity car

-

- Current identity card issued by the Electoral Office for Northern Ireland

-

- Residence permit issued by the Home Office

-

- Another must include your name and address for example, see list below:

-

- Benefit book or original notification letter from the DWP confirming the right to benefits

-

- Council tax bill (no older than 3 months)

-

- Utility bill or statement, or a certificate from a utilities supplier confirming an arrangement to pay services on pre-payment terms (no older than 3 months)

-

- Cheque or electronic transfer drawn on an account in the name of the client with a credit or financial institution regulated for the purposes of money laundering

-

- Bank, building society or credit union statement (no older than 3 months) or passbook containing current address

-

- Solicitor’s letter confirming recent house purchase or land registry confirmation of address

-

- Local council or housing association rent card or tenancy agreement

-

- HMRC self-assessment statement or tax demand

-

- House or motor insurance certificate

The law requires solicitors to get satisfactory evidence of the identity of their clients and sometimes people related to them. This is because solicitors who deal with money and property on behalf of their client can be used by criminals wanting to launder money. To comply with the law, we need to get evidence of your identity as soon as possible. Our practice is to obtain a copy of your passport or photo card driving license and a utility bill addressed to you. If you cannot provide us with the specific identification requested, please contact us as soon as possible to discuss other ways to verify your identity. We are professionally and legally obliged to keep your affairs confidential. However, solicitors may be required by statute to make a disclosure to the National Crime Agency where they know or suspect that a transaction may involve money laundering or terrorist financing. If we make a disclosure in relation to your matter, we may not be able to tell you that a disclosure has been made. We may have to stop working on your matter for a period of time and may not be able to tell you why.

Service Levels – Your Responsibilities

We will update you by telephone, email or in writing with progress on your matter regularly. If, however there is a period of inactivity on your file because we are unable to progress the matter for any particular reason, we shall reduce the frequency of updates to monthly. We will communicate with you in plain language. We will explain to you by telephone/email or in writing the legal work required as your matter progresses. We will update you on the cost of your matter quarterly. We will update you on whether the likely outcomes still justify the likely costs and risks associated with your matter whenever there is a material change in circumstances. We will update you on the likely timescales for each stage of this matter and any important changes in those estimates.

How You Can Help Us

You communicate with us by phone, e-mail, letter or personal attendance here or elsewhere at your request. We understand that you will be our primary contact for communication and that we can properly act on your instructions, whether oral or written. Please let us know if, in the interests of confidentiality, you have any specific requirements.

-

- You will provide us with clear, timely and accurate instructions.

-

- You will provide all documentation required to complete the transaction in a timely manner.

-

- You will safeguard any documents that are likely to be required for discovery.

Alternative Funding Methods

This firm does not hold a legal aid franchise. You are therefore personally responsible for paying us our professional charges. You may be entitled to legal aid. The Legal Services Commission and the Citizens Advice Bureau will have a list of firms in the area that provides assistance through the Legal Aid Scheme. Legal Aid is no longer available in most personal injury cases. However, after the event insurance cover may be available providing cover for your own costs and disbursements as well as your opponents’. We may require you to take out such a policy if it becomes necessary as the case progresses. If you wish to discuss this matter in more detail please contact us immediately. Other methods of funding your case may be available including private funding, other legal expense insurance policy and trade union funding. It is essential that you make enquiries into whether your claim can be funded by some other method and in particular we would ask that you check through your household insurance policy, your motor insurance policy, any personal health care or any personal insurance policies you hold to see whether they operate a legal expense insurance policy, whereby your costs will be covered under that scheme. If you are a member of a trade union or a member of any other society or club, please check whether they offer legal services under the terms of your membership.

How We Calculate Our Basic Charges

Fixed pricing gives you certainty as to the amount that you will pay for the work that you instruct us to do at the outset. Unless we have agreed a fixed fee with you in writing, we will charge on a standard time basis, this is based on hourly fees of between £111.00-£250.00 + VAT depending on the seniority and experience of the Solicitor/ fee earner involved and the complexity, urgency and importance of the work, in which case the estimate will based on a specified number of hours of work and, where appropriate, a specified precedent fee for using our precedents. Our charges include advising you, attending to you, dealing with documents, correspondence etc. Our costs are calculated for each hour engaged on your matter. Our hourly rates are reviewed annually in January of each year and you will be informed in advance, if any increased rates will be applied to your work. Otherwise, our hourly rates are fixed at the outset of a matter, any lawyer who spends time on your matter will record their time. Routine letters and telephone calls will be charged as units of one tenth of an hour (units of six minutes). Other letters and telephone calls will be charged on a time basis. The hourly rates, excluding VAT, are:

-

- Solicitors Advocates and other Solicitors and Legal executives with over 8 years’ experience £281.00 per hour. £350.00 p/h (multi-Track)

-

- Solicitors and legal executives with over four years’ experience: £240.00 per hour (£300 p/h multi-track)

-

- Other solicitors or legal executives and fee earners of equivalent experience £195.00 per hour. (£250 p/h multi-track)

-

- Trainee solicitors, paralegals and other fee earners £139 per hour. (£200.00 p/h multi-track)

Our hourly fees are reviewed from time to time.

We will let you know if there are any changes that may affect you. We will review the hourly rate on the review date and on each anniversary of the review date. We will not increase the rate by more than the rise in the Retail Prices Index and will notify you of the increased rate in writing. Sometimes we will deal with a matter for you on a fixed fee basis, for example if we agree to appeal to a Tribunal against an immigration decision, and we will confirm in writing the agreed fixed fee. If for example, the scope of the initial work changes because the Respondent withdraws his decision, you will of course be advised of any reduction to the agreed fee. We confirm that under no circumstances will the fixed fee be varied upwards. In addition to the above, we will also charge for expenses we incur on your behalf such as travel costs, couriers’ fees, barristers’ fees, company search, trademark search and registration fees etc and will give you an estimate of these charges. Some of the expenses will also include VAT, which will be added (where appropriate) to the overall charge. We may not need any money on account of costs in the initial stages. Where we are charging on an hourly rate, different hourly rates may be charged for different types of work, and according to the seniority of the person who handles it for you. Time spent on dealing with your instructions will include:

-

- Meetings with you and perhaps others;

-

- Negotiating with others on your behalf in meetings, by letter, e-mail, fax and by telephone

-

- Considering, preparing and working on papers, deeds, etc.;

-

- Reporting back to you as necessary or required;

-

- Preparing for Court or Tribunal hearings, including travelling and waiting time;

-

- Instructing third parties on your behalf; Legal and factual research;

-

- Correspondence and communications (sent and received including by letter, e-mail, fax and text);

-

- Making and receiving telephone calls; and

-

- Preparing detailed costs calculations

Sometimes, where the nature of the work warrants a different basis for charging, we may calculate our fixed price or estimate and subsequent fees taking into account additional factors other than time spent. Such factors may include the complexity of the issues, the speed at which action must be taken, the expertise or specialist knowledge which the case requires or, if appropriate, the value of the property or subject matter involved. In such cases, the basis of our charges will be made clear to you at the outset, or when it becomes apparent that such factors will influence the estimate or basis of the charge. Minor expenses, e.g. postage, telephone calls and reasonable photocopying done internally, arc included in our fees. However, as the work progresses, we may need to ask for such a payment if our exposure increases. Parkview Solicitors and Higher Court Advocates reserve the right to terminate the retainer, in effect, cease to act on your behalf; if at any time the sums we hold on your account are insufficient to meet the costs incurred and any time outstanding on your account.

Payments to Third Parties (Disbursements)

Some types of work (e.g. property purchases and settlement of claims) may require you to make payments to third parties, in addition to legal fees and VAT. Such payments (`disbursements’) to third parties will be made on your behalf as work progresses, and might include court fees, search fees, barristers’ fees, etc. Payments will be made from your money held by us in the firm’s client bank account. Please respond quickly to any request for payment in advance of expected disbursements, as any delay in providing cleared funds may delay your transaction. We may not be able to take the next step if the money is not available to use as cleared funds. Where money is to be paid to a third party you should allow seven working days for any cheque deposited with us by you (or anyone on your behalf) to clear to enable us to make such payments. Where disbursements are relatively small, we may exercise discretion and make payments without your specific instructions. If you prefer, however, we are willing to undertake not to make such payments without reference to you, although this may cause delay. Please notify our offices should this be the case.

Transmission of Funds

In many cases it will be quicker and more convenient to transmit and receive funds electronically by telegraphic transfer and I/we will advise you when this is appropriate. When we transmit funds by telegraphic transfer on your behalf I/we make a charge for this service which will include the actual bank charge to us for the transfer.

Your Liability For The Legal Costs Of Others

It is important to be aware that this firm is employed by you and that you are personally responsible for the payment of our fees regardless of any order for costs made against opponents. In addition, if your case is unsuccessful, you will probably have to make a contribution to your opponent’s costs as well as being required to pay all of your own. Please ask us if you would like further advice on your potential liability for your opponent’s costs. If you are successful in your case it is important to note that the most that you can usually hope for is that the other party will be ordered to pay part of your costs and you will therefore have to pay the remainder. There are also circumstances in which you will still have to pay all of our fees even though you have been successful, such as where your opponent is in receipt of legal aid (`public funding’) or your opponent is bankrupt.

Time Recording

As lawyers we sell our time and expertise. Time is therefore very important to us and to you as the client. Time spent on your file is recorded in units of six minutes, and fractional units are rounded up to the next whole unit. Please remember that we have to prepare for meetings by reading through any documents and background materials you have provided us with, and that the Solicitors Regulation Authority requires us to make notes of telephone calls and meetings that we have with you. We also charge for travelling time and waiting time at the same rate (as detailed above).

Invoices

We will usually issue bills on a monthly basis. Where a matter has been going on for some time we may issue interim bills, which are payable as set out below. We issue separate bills on separate pieces of work we are doing for you, because most clients find that this helps them to allocate the separate bills to separate cost centres. This means that if, for example, we send you a bill in respect of advice given on a trademark, and this will not cover work undertaken on a domain name dispute during the same time. Payment of our bills is due on completion of a matter or within fourteen days of us sending the bill to you, whichever is the earlier. We reserve the right to charge interest on late payment. This letter is written on the basis that you are our client and or its agent to whom we will look for payment of our fees. You have the right to challenge, or complain about any bill you receive from us, including your right to apply for assessment of the bill under Part III of the Solicitors Act 1974. Our normal practice is to issue bills by post rather than by email, but we need your agreement to do so by email. We would propose that we issue all bills to you using the e-mail address that you have supplied or by post, whichever method seems suitable at the time, but if you would prefer us not to send out bills by email please notify our offices as soon as possible.

General Invoices on Account

If work is completed within a short period of time, it will normally be invoiced in full on completion. Otherwise, interim invoices will be raised at regular intervals as work progresses — generally monthly or as otherwise indicated in our engagement letter to you. They will not necessarily cover all work done but this will be made clear to you. When sending an interim invoice any payments made on account will be shown and we may ask for further funds on account so that we can continue work on the file. Interim invoices for fixed price work may be calculated either by reference to the time spent on the matter or to the particular stage reached in the matter, or as a percentage of the total fixed fee.

Final Invoices

Once the matter is concluded we will render a final invoice for all outstanding fees, disbursements and VAT, excluding any charges already included in interim invoices. Sometimes, the final invoice will include an allowance for concluding work that will be necessary to close your file after the legal transaction is completed, but this will be explained to you. Any money due to you will be paid by cheque or bank transfer: it will not be paid in cash or to a third party.

Payment of Invoices

All invoices must be settled within 14 days of the date of invoice. We reserve the right to charge interest on outstanding accounts (calculated daily from 14 days after the invoice date to the date of payment) at the rate payable on debt (currently eight per cent) or, where a client is a business, the rate allowed under the Late Payment of Commercial Debts (Interest) Act 1998. Where we are holding money due to you, e.g. on completion of the sale of a property or where we have recovered monies from a third party on your behalf, fees and disbursements due to us and VAT (where applicable) will be deducted and the balance paid to you. In the event of payment not being made within these terms, we reserve the right to suspend work on your file where the account is unpaid and on any other matters being dealt with for you and, ultimately, to decline to represent you further. In those circumstances, final invoices will be rendered for work on all matters calculated to that date. In all cases, while there is money owing to us for payment of our charges or expenses we will be entitled to keep all papers and documents until all invoices are paid.

Value Added Tax

This, again, is a requirement under the Provision of Services Regulations 2009. This firm is registered for VAT under registration number GB 160 0803 51. We are therefore required to add VAT to our charges at the rate in force at the time (currently 20 per cent) to fixed prices, estimates and invoices. VAT may also be added to some disbursements.

Disclosure

We are committed to providing a high quality service. Our performance, practices and procedures are monitored regularly and our files (which includes yours) are inspected by independent auditors. For your information the audit is privileged and confidential. We reserve the right to allow your file to be audited.

Data Protection – GDPR Privacy and Transparency Notice

Data Controller – Parkview Solicitors & Higher Court Advocates and Parkview Solicitors are trading names of Parkview Solicitors Ltd who is the data controller, Registered as a company in England & Wales. Registered office: Hamill House 112-116 Chorley New Road Bolton BL1 4DH. Authorised and regulated by the Solicitors Regulation Authority – 636959. Further contact details are available from https://www.parkviewsolicitors.co.uk/contact-us/

Purposes of Processing – Your data will be processed in order to:

-

- Market Parkview Solicitors Ltd services to you;

-

- Provide services under contract to you and others;

-

- Comply with regulatory and other legal obligations; and

-

- Protect Parkview Solicitors Ltd against potential claims.

Legal Basis – Your data will be processed on the basis that Parkview Solicitors Ltd has a legitimate interest in being able to achieve the aims of processing set out above. Where special category data is provided, the provider of the data warrants that they consent to Parkview Solicitors Ltd processing that data or that they have obtained written consent from the data subject.

Personal Data Held – As a minimum, Parkview Solicitors Ltd is required to positively identify its clients. This also includes positively identifying a director in the case of a corporate client. In addition, Parkview Solicitors Ltd holds whatever information is provided to it by its clients and others. This will rarely include special category data.

Failure to Provide Data – If you fail to provide Parkview Solicitors Ltd with the data required you will not receive services or marketing.

Data Sources – Parkview Solicitors Ltd obtains most personal data from its clients and those who have indicated that they have an interest in Parkview Solicitors Ltd services. Parkview Solicitors Ltd also obtains some personal data from other correspondents. Parkview Solicitors Ltd also collects some data from publicly available sources (e.g. Companies House, Land Registry).

Recipients – Any data provided by a client is treated as confidential to that client and will only be shared with others in so far as this is necessary in order to provide the services contracted for by the client, to comply with regulatory and other legal obligations and to protect Parkview Solicitors Ltd against a potential claim. In order to provide its services, Parkview Solicitors Ltd relies on the services of certain data processors. These include secure cloud storage for files and emails. In each case, Parkview Solicitors Ltd ensures that data is processed in compliance with this policy.

Third Countries and Safeguards – Other than where required in order to provide services as required in individual client matters, data is rarely sent to third countries. Where it is, the relevant devices are password protected and equipped with tracking and remote wipe software. The devices are personally accompanied.

Retention Period – Data is held for six years from the end of the relevant matter or for six years where not associated with a particular matter.

Data Subject’s Rights – Where relevant, you have the right (subject to client confidentiality) to:

-

- Withdraw consent to the processing of your data;

-

- Complain to a supervisory authority regarding the processing of your data (https://ico.org.uk/);

-

- And obtain a copy of the data held on you and to correction of any errors in that data.

-

- Automated Decision Making – None.

-

- We use the information you provide primarily for

-

- the provision of legal services to you and for related purposes including:

-

- Updating and enhancing client records

-

- Analysis to help us manage our practice

-

- Statutory returns

-

- Legal and regulatory compliance

Our use of that information is subject to your instructions, the GDPR General Data Protection Regulation and our duty of confidentiality. Please note that our work for you may require us to give information to third parties such as expert witnesses and other professional advisers. You have a right of access under data protection legislation to the personal data that we hold about you. We may from time to time send you information that we think might be of interest to you. If you do not wish to receive that information please notify our office in writing.

Interest Policy

In accordance with the SRA Accounts Rules 2011 it is the firm’s policy to account to its clients for interest on a fair and reasonable basis for both client and the firm. When we receive monies on behalf of a client it will be paid into a general client account with NatWest bank who is the firm’s banker. This general client bank account will hold pooled amounts for different matters and clients. These will be based on client money being held in an instant access account to facilitate a transaction. Clients are unlikely to receive as much interest as might have been obtained had they held and invested the money themselves. The rate of interest paid to clients on money held in the general client account is in line with the Nat-West published rates on Client Deposit Manager Accounts — currently 0.1%. We calculate interest on client money that has been held for more than a week. Interest on general client money is calculated on cleared funds on a daily basis at the closure of the matter. In the event that the calculated total interest accruing to a client for the duration of a matter is £20.00 or less then no interest will be paid to the client on the basis that it is a de minimise amount. It is reasonably retained by the firm to cover the administrative cost of dealing with client funds. If you are to deposit money with us for anything other than short periods of time we can place the funds in a Designated Deposit Account for an administration fee of £20 + vat. If you wish to do this please contact us for the current rates. However we must stress that we are neither financial advisors nor investment specialists so we are happy to return the funds to you if you wish to achieve a maximum investment. If the bank in which the firm holds funds should fail we reserve the right to disclose to the FSCS the names and other details of clients whose money is held there in order for those clients to claim compensation up to the applicable limit, currently £85,000. We will not be liable to you or any third party for any loss or damage suffered as a result of any act, omission, fraud, delay, negligence,

insolvency or default of any bank, financial institution, clearing or payments system nor that of the directors, officers, employees, agents or representatives of any of the foregoing. This policy will be reviewed from time to time to ensure the over-riding objectives are met.

Storage of Documents

After completing the work, we will be entitled to keep all your papers and documents while there is still money owed to us for fees and expenses. We will keep our file of your papers for up to six years, except those papers that you ask to be returned to you. We keep files on the understanding that we can destroy those six years after the date of the final bill. We will not destroy documents you ask us to deposit in safe custody. If we take papers or documents out of storage in relation to continuing or new instructions to act for you, we will not normally charge for such retrieval. However we may charge you both for:

-

- Time spent producing stored papers that are requested

-

- Reading, correspondence or other work necessary to comply with your instructions in relation to the retrieved papers.

Termination of Instructions

If you are a client instructing us other than in the course of business the provisions of the Consumer Contracts Regulations may apply to the work we undertake for you and you may be entitled to cancellation or ‘cooling-off rights in certain circumstances. You will be advised where this is the case. You may end your instructions to us in writing at any time, but we can keep all your papers and documents while there is still money owed to us for fees and expenses. In the event that either you or we decide to end our involvement on your case you will be liable to pay any charges and expenses that are already outstanding, and for the work done up to that point which has not been billed. Our fees will be calculated on an hourly rate basis plus expenses, or by proportion of an agreed fixed fee if that is the basis on which we are acting for you. If work which we have undertaken for you does not proceed to a conclusion, we will charge only for work done up to the point where the matter proves abortive and for any disbursements paid on your behalf. In the case of fixed fee work charges will not exceed the fixed fee or, if we have agreed fixed fees in relation to stages of work, the charges will not exceed the fixed fees up to the end of the stage that we are involved in at that time. If we are acting for you on a Conditional Fee Agreement basis, the Agreement will set out in detail the basis upon which you or we may decide that we will no longer act for you and how that affects your liability to pay this firm’s outstanding charges and expenses It should be noted that if the retainer is terminated without good reason then a solicitor may not be able to require the client to pay for work done up to this point. (Minkin v Cawdely Kaye Fireman & Taylor (A firm) [2011] ETVHC 177 (Q8) and Underwood Son & Piper v Lewis [1894] 2 Q13 306).

Warranties, Personal Liability for Invoices and Personal Guarantees

Where you, the client, are a limited company, other corporate body or corporation that is recognised as having a separate and distinct legal personality, the individuals instructing us on behalf of that body, by signing the confirmation of instruction sheet, are warranting that the organisation has sufficient funds to meet its commitments to us. Where you, the client, are an unincorporated association or other body without legal personality, the members will be personally liable for our fees. Where instructions are received from an individual it is agreed, without further enquiry that the individual responsible for those instructions has the authority of the limited company, other corporate body or corporation or members to give instructions to us and agrees, in default of payment by the limited company, other corporate body or corporation or members, to be jointly and severably responsible with the directors or members or the organisation to make any payments that are due to us personally. Where we consider it appropriate we may, as a condition of our acting, request a personal guarantee from one or more directors or other individuals instructing us on behalf of a company or association or from controlling shareholders or beneficial owners.

Lien

Pending payment in full of all charges due to us we will exercise our right (known as a lien) to retain any file papers, documents, deeds or securities. Sometimes release of papers and other documents may be possible to a subsequently-instructed solicitor provided that an undertaking for payment of all costs has been given and is acceptable to us in our discretion.

Complaints

Parkview Solicitors LTD is committed to high quality legal advice and client care. If at any point you become unhappy with the service we provide to you, then please inform us immediately so that we can do our best to resolve the problem for you. We have a procedure in place which details how we handle complaints which is available upon request. You can obtain a copy of our complaints procedure by emailing us at info@parkviewsolicitors.co.uk or in writing to our office. If we are unable to resolve your complaint then you can have the complaint independently looked at by the Legal Ombudsman. The Legal Ombudsman investigates complaints about service issues with Lawyers. The Legal Ombudsman expects complaints to be made to them within one year of the date of the act or omission about which you are concerned or within one year of you realising there was a concern. You must also refer your concerns to the Legal Ombudsman within six months of our final response to you. The Legal Ombudsman’s contact details are: – Telephone: 0300 555 0333 Minicom: 0300 555 1777 Website: www.legalombudsman.org.uk Post: Legal Ombudsman, PO Box 6806, Wolverhampton, WV1 9WJ

Commission

We may receive commission from third parties as a result of the work carried out on your tile, such as for the arrangement of ATE legal policies or for the provision of detailed instructions to medical experts and/or agencies. The financial sum can vary from case to case but normally will not exceed £150.00. By signing this client care you provide us with your express consent that we may retain the same.

Hearings

Please note that in the event that your instructed Lawyer is unavailable to attend any hearing due to unexpected circumstances or professional commitments, we shall instruct an external barrister to attend in which case we may need to revise the estimate of costs but we shall endeavor to incorporate the barrister’s attendance fee within the estimate. The estimate covers our advice to you on the prospects of success, evidential requirements, case preparation and attendance at the first hearing. If your hearing is adjourned at court, there will be additional charges for attending any relisted hearings. Barrister’s attendance fees in cases of adjourned hearings will be according to their relevant charges which you will be notified of after such an event.

Equality & Diversity

We are committed to equality and diversity in all of our dealings with clients, employees and others. Please contact us if you would like a copy of our equality and diversity policy

Professional Indemnity | Public Liability Insurance

As a firm of solicitors this practice is authorised and regulated by the Solicitors Regulation Authority, whose rules can be found on their website at www.sra.org.uk/handbook. A certificate of Insurance is available for viewing at all our offices and at Hamill House, 112-116 Charley New Road, Bolton, BL1 4DH.

Cancellation of Work Request

Please download, complete and return this form to us if you wish us to cease acting on the instructions you have provided only.

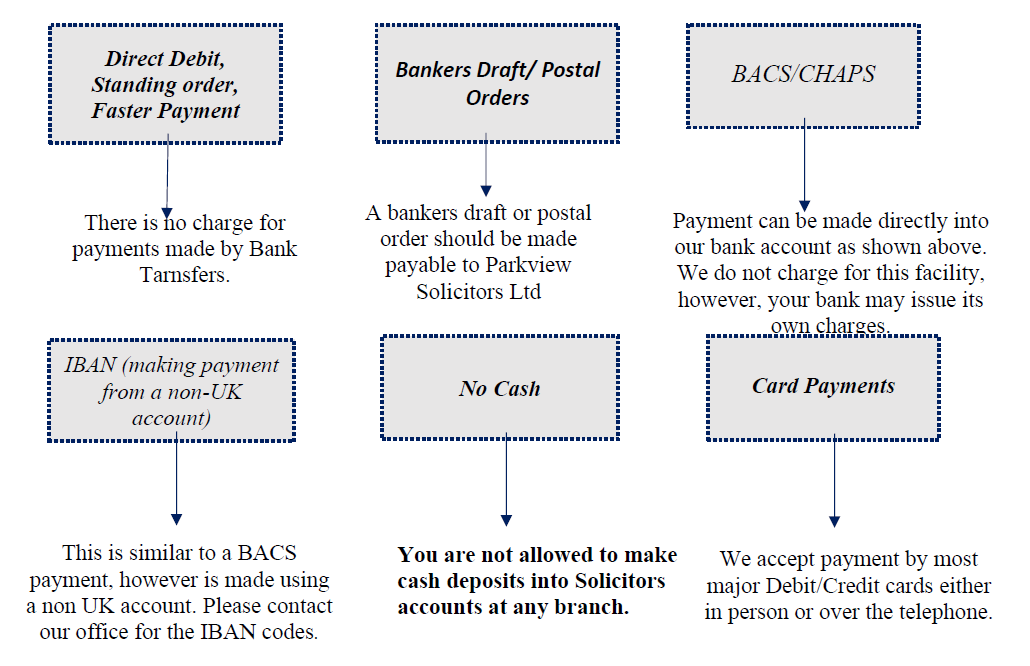

Acceptable payment methods and charges.

For payments directly from your bank or online, our account details are as follows:

-

- Natwest Bank

-

- Account Name – Parkview Solicitors

-

- Sort Code 01-30-99

-

- Account number 73049050

-

- Your Unique Reference: «Reference»

Commencement of Work Request

You can download a copy of our Commencement of work Request form here.

We’re based in Bolton (Greater Manchester), but help clients in the North West and throughout the UK.

Bolton (Head Office)

Hamill House

112-116 Chorley New Road

Bolton

BL1 4DH

Burnley Office

Northbridge House

Elm Street Business Park

Elm Street

Burnley, BB10 1PD

Call us today on

01204 565 234

Call us today on

01282 575 234

Contact Us

For expert advice, complete the form below and we will get in touch with you.